The Trillion Dollar Club

6/12/2023

When Groucho Marx was invited to join an exclusive country club, he reportedly said, “I don’t want to belong to any club that would have me as a member.” I was thinking about Groucho’s comment recently when Nvidia joined the exclusive Trillion Dollar Club.

The Trillion Dollar Club is the unofficial moniker given to the list of all companies with a market capitalization greater than one trillion U.S. dollars. In simplest terms, market capitalization is the market price per share of a publicly traded company multiplied by the total number of shares outstanding.

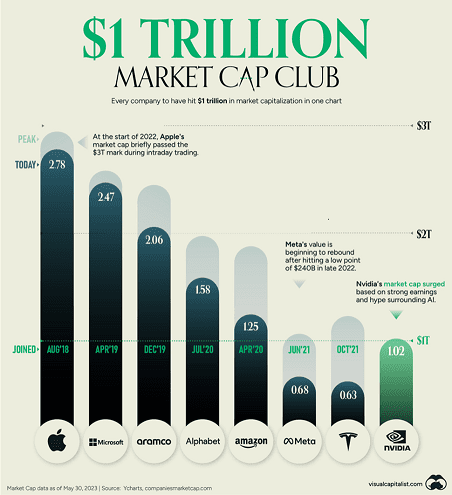

Just how exclusive is the Trillion Dollar Club? Only eight firms have ever managed to achieve a market cap greater than $1 trillion. Apple was first, crossing the $1 trillion threshold in August of 2018. It later fell out of the club for a while before advancing to the highest-ever observed market cap of just over $3 trillion in January of 2022. Microsoft was second to join, passing the $1 trillion mark in April of 2019. Aramco, the Saudi Arabian Oil Group, is the only non-U.S. name on the list. It joined the club immediately with a market cap north of $1 trillion at its initial public offering in December 2019.

Not everyone who joins the club gets to stay. Tesla was in and out a couple of times in less than a year. Meta was also in and out in less than a year. Both have a way to go before being readmitted.

Nvidia’s rise has been a quick one. Its stock is up more than 165% just this year. On May 25th alone, Nvidia added $184 billion to its market cap, which is more than the total market cap of 463 of the S&P 500 constituents. Amazon and Apple are the only two companies to ever eclipse that level of market cap increase in one day.

One of the big ideas in finance is that financial markets are relatively efficient, meaning asset prices reflect all available information and are priced about right most of the time. It is extremely difficult to beat the wisdom of crowds, so the thinking goes, especially in the big, U.S.-listed large cap names, like Nvidia. What can you possibly know that the market doesn’t know?

I tend to agree with that logic, with emphasis on the phrase “most of the time.” Most of the time, the market gets it about right. Sometimes, however, investors get enthralled with an idea, for whatever reason, and embark on a speculative frenzy. They herd into things, sometimes recklessly, with blatant disregard for any relationship with fundamental value. The narrative is the value. A good example would be the fervor for Bitcoin around the time of Matt Damon’s “Fortune Favors the Brave” commercial. That was an invincible narrative, for a while. Then Bitcoin went on to lose more than two-thirds of its “value” in less than a year.

Which brings us back to Nvidia. Maybe Nvidia was worth two and a half times in May what it was worth in January. Who knows, maybe Nvidia will be worth two and a half times more by December. Anything is possible, I suppose. But something tells me Nvidia may have joined a club where they don’t belong, at least not yet.

Mike Masters