Red Hot

June 21, 2021

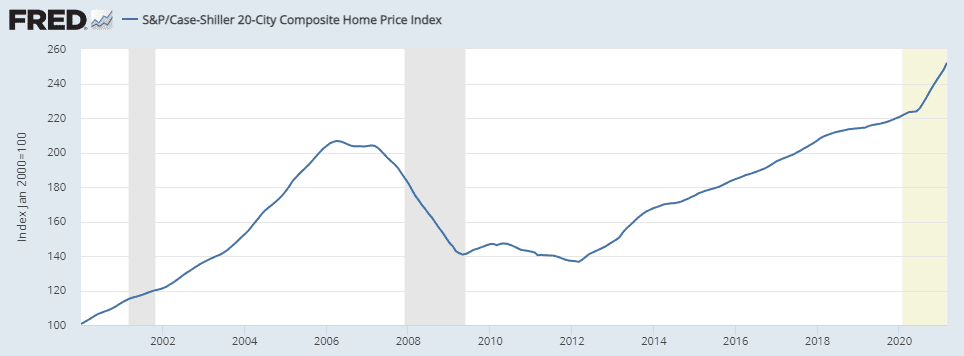

Over the past 12 months, many individuals have decided to move to a new residence. For all those who have contemplated selling, refinancing, or purchasing, one thing has been abundantly clear – the housing market in the United States is red hot! The Shiller-Case Index, developed in part by Nobel prize-winning economist Dr. Robert Shiller, tracks the changes in home prices throughout the United States. The index reported an 11% increase from the period February 2020 to February 2021. Compared to the 2.1% increase from 2019 – 2020, this was a remarkable jump.

Several factors have contributed to this recent surge, chief among them has been low-interest rates and shifts in homeowner preferences. Early in the pandemic, COVID-related concerns and newly implemented work-from-home policies forced city dwellers to reevaluate the need to live near their company offices, especially in the cramped, expensive apartments of Los Angeles or New York City. As a result, many opted for more space and the relative affordability found in other areas of the country. According to Zillow’s research, the hottest markets for 2021 include Austin, Phoenix, Nashville, Tampa, and Denver. These are all medium-sized cities that are less dense, have lower taxes, and are close to beaches, parks, mountains, and rivers, popular among those looking for a secluded getaway outdoors.

Eighty-four percent of real estate experts and economists surveyed by Zillow expect home price increases in Austin to outperform national averages next year, despite the already 24% increase that took place in 2020. Nashville was not far behind, with 67% expecting outperformance. According to Redfin, homes in Austin have sold on average, at 10% above their list price over the last 12 months. These homes remain on the market for an average of 26 days. While prices have skyrocketed in these regions, it is easy to see how a $600k, 1,800 square foot house with a yard, just a short car ride from Lake Austin or the Smoky Mountains, has an appeal over the $1M, 1,000 square foot condo in the city.

Rising home prices can make it more difficult to come up with the 20% down payment, but for those who have saved enough capital to afford it, mortgage rates may now be lower than 3%. Borrowing at this rate over 30 years is very attractive in an environment where housing prices have appreciated 10+% over last year alone. Plus, with rental prices beginning to rise, locking in a known monthly housing payment brings peace of mind to those who fear inflationary pressures will push rising rents even higher.

As we know, trees do not grow to the sky, and growth in housing prices will not continue at this rate forever. With approximately 50% of the US population vaccinated, companies are beginning to bring employees back into city offices. As the economy recovers and those who experienced a job loss get back to work, rates may well need to increase to combat rising prices. It is uncertain where we go from here, but this market has been an exciting one to follow and, I think, will continue to be in 2021.

Corey Erdoes