“Looking for Love in All the Wrong Places”

November 22, 2021

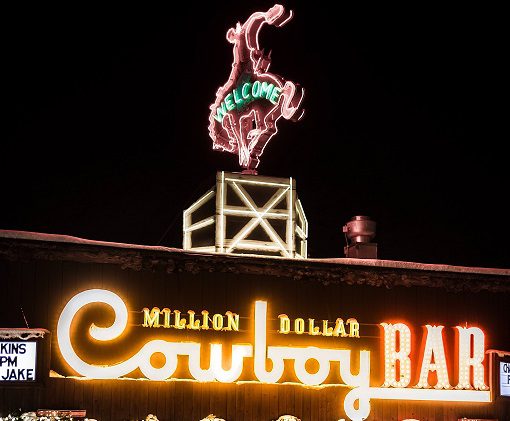

The iconic 1980 movie Urban Cowboy featured a song by Johnny Lee entitled “Looking for Love in all the Wrong Places.” What’s that got to do with markets, the economy, and investment opportunities? Everything.

The current growing risk is the widening gap between what the Fed is saying and doing and the increasing prices in the marketplace. Fed officials continue to suggest inflation is temporary, while the prices consumers pay every day suggest inflation is here to stay. Many products are scarce, and prices are going up across the board. Investors concerned about longer-lasting inflation are scrambling to find safe yielding assets to own, which will protect them against rising inflation. Not an easy task given the Fed continues to keep interest rates low to support a post-COVID recovery. This investor frenzy to find yield has left many “Looking for Yield in all the Wrong Places?”

Investors recently received an update on inflation. The latest monthly Consumer Price Index (CPI) showed prices had gone up by 6.2% in the last 12 months. Some sectors reported even more shocking results: Gasoline was up 49.6%, used cars were up 26.2%, and the cost of natural gas to heat your home increased by 28.1%. Meanwhile, the “real yield” available on many traditional fixed-income investments is negative, meaning inflation is higher than the yield on bonds. Too bad it’s not 1980! Back then, after watching John Travolta at his urban best, investors could buy 10-year Treasury notes and receive a 12% interest rate! Today, the same 10-year note is earning a paltry 1.60%. Invest and earn 1.6% while prices are rising at 6.2% – a very safe way to lose your money if inflation persists. Buying low-yielding assets when inflation is low is one thing, but buying them when inflation is high is a recipe for longer-term financial indigestion!

So, what are our yield-hungry investors doing? It seems many are waiting, watching, and hoping. One place to hide, of course, is cash. An enormous supply of cash still sits on the sidelines, waiting to be invested. Corporations are sitting on $7 trillion in cash while consumers hold an additional $3 trillion. Both of these groups are focused on finding higher returns for any investments they make. Corporations are looking at buying back stock, investing in better technology, and acquiring other companies. Many consumers have been willing to buy more stock. Others are turning to alternatives like real estate and crypto. All this action continues to feed a strong equity market that some wish would experience a “correction” (I.e. go down), so they can buy back in.

At some point, either inflation will moderate, or the Fed will give. Depending on how this face-off resolves, there could be a very rough ride ahead for the economy and investors. It might even look like all those folks trying to ride the mechanical bull in Urban Cowboy.

Carl Gambrell