The Painful Math of Inflation

November 29, 2021

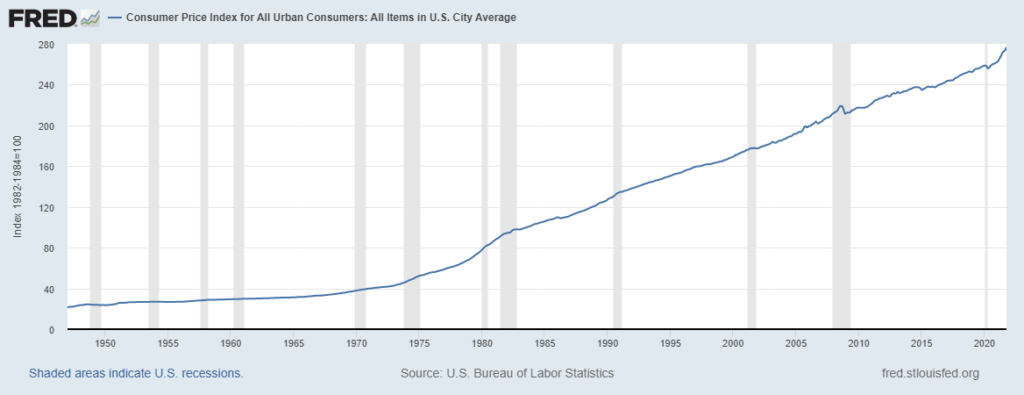

There have been a lot of questions raised lately about inflation. Is it transitory? What goods and services have been the most impacted? Where are interest rates headed? What might be the longer-term effect on stock prices? As we think about these questions, we should remember that, apart from loss in a bad investment, inflation is one of the two greatest headwinds to returns (the other is taxes).

Over the last century, T-Bills have compounded at around 3.4% per year. During this same period, inflation has averaged 2.9%. I remember the days when savers shopped for CDs (Certificates of Deposit) looking to invest up to the maximum FDIC insured amount in several banks. The hunt was for a bank paying a slightly higher interest rate for a 3-, 6- or 12-month deposit. Those days seem like ancient history.

Today I want to focus on the math behind the impact of inflation on the taxable investor. For our lesson, I am going to assume an inflation rate of 3%, a return on CDs of 4% (a generous 1% more than the inflation rate), and that our CD saver pays a combined Federal and State income tax of 40% on the interest earned.

So, on a 4% annual return 1.60%, (40%) goes to taxes and 3% to inflation. This leaves the saver with a negative 0.6% return (4% – 1.60% – 3% = -0.60%).

But it gets worse! The hidden tax of inflation creates a scenario where the more you make, the more you lose! If to the delight of our saver, banks start paying 10% per year on a CD because inflation has risen to 9%, the negative return is now -3% (10% – 4% -9% = -3.0%).

I am not suggesting that savings in CDs have no value. There are times when holding cash in secure accounts makes a lot of sense, and there are significant benefits to keeping your “powder dry.” But let us not confuse short-term savings with long-term investing.

In a 1977 article entitled “How Inflation Swindles the Equity Investor,” Warren Buffett wrote:

The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislatures. The inflation tax has a fantastic ability to simply consume capital. It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent tax on her interest income during a period of zero inflation or pays no income taxes during years of 5 percent inflation. Either way, she is taxed in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 120 percent income tax but doesn’t seem to notice that 6 percent inflation is the economic equivalent.

Over a long period, high inflation enables careful savers to “lose their money safely!”

Nick Hoffman