Where the Action Is

December 06, 2021

You might not agree, but I think the financial markets are always exciting and rarely more than this past week. They offered plenty to talk about. From Omicron to inflation, Fed tapering and tightening, a potential government shut down, and a looming debt ceiling breach. There was a good year’s worth of action-packed into five days. Perhaps we shouldn’t be surprised that stocks were up more than 1% on Monday and Thursday then down more than 1% on Tuesday and Wednesday. After all the commotion, the S&P 500 remains up more than 20% on the year and less than 4% below its all-time high.

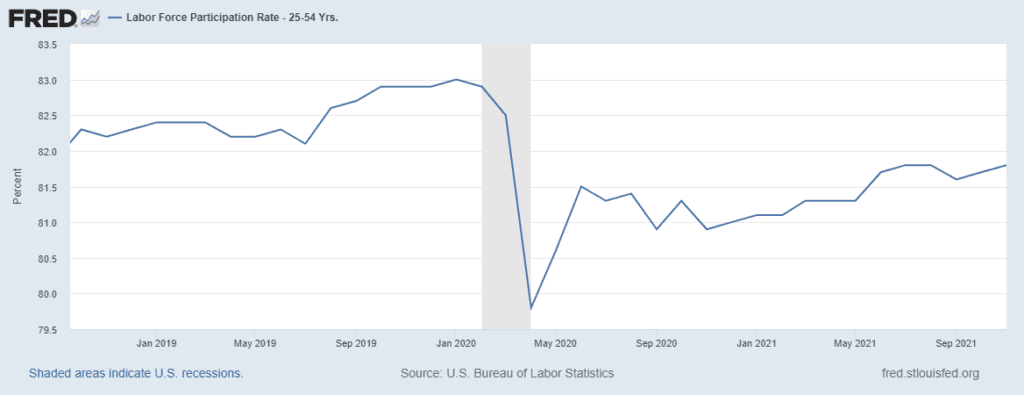

Federal Reserve policy was one factor driving the narratives this past week. The Fed has a dual mandate: to promote price stability and maximum sustainable employment. Although Friday’s jobs report missed headline expectations, the underlying story was much more positive than it appeared on the surface. The unemployment rate dropped from 4.6% to 4.2%, the best print since the start of the pandemic. The Bureau of Labor Statistics’ Household Survey showed over a million more people were employed and the labor force grew by nearly 600,000. The greatest improvement was among 25 to 54-year-old prime-age workers. These are all good signs, and the Fed’s progress on the employment part of its mandate looks good.

The Fed’s success in promoting price stability is much more debatable. In simple terms, the Fed has been wrong on inflation this year, which has been higher and more persistent than the Fed was expecting. In Congressional testimony last Tuesday, Fed Chairman Powell suggested it was time to retire the word “transitory” when referring to inflation. Markets sold off sharply on what hardly seemed like a revelation. Of course, the Fed’s tools for fighting inflation are blunt. The main option is to raise interest rates to try and tamp down excess demand. Powell’s comments increased the prospect of earlier Fed tightening, which added to the selling pressure last week.

With the markets still lacking direction, the next round of information relevant to the economy will be important. The major data points this week are the JOLTS (Job Openings and Labor Turnover Survey) on Wednesday, then CPI (Consumer Price Index) and the University of Michigan Consumer Sentiment Index on Friday. CPI is expected to be up 0.65% for November, according to Barron’s. We wouldn’t expect much volatility unless the numbers were meaningfully different than expectations. The Michigan data could be more telling as it should give some insight into how people are feeling in the context of higher inflation and increased uncertainty about the pandemic.

There will undoubtedly be other factors vying for attention as the week unfolds, with the latest evaluation of the Omicron variant likely to be the most notable. One thing is for certain – this is a great time for market nerds like me to observe and interpret as events unfold.

Mike Masters