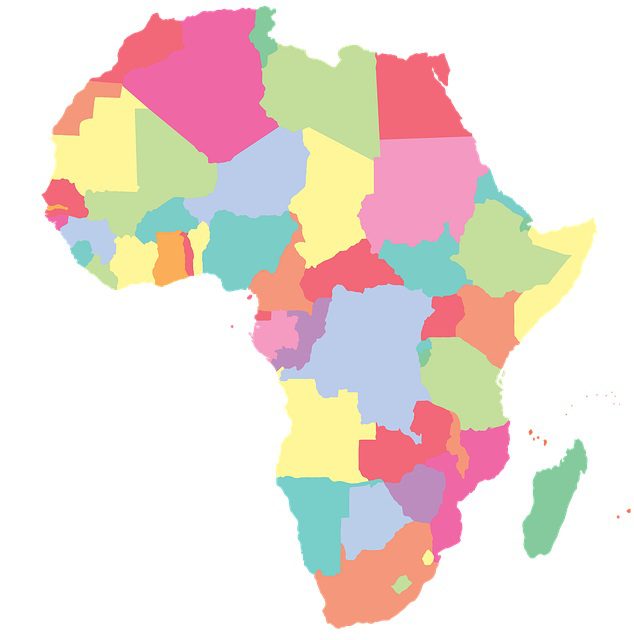

I do not believe that organizations like Prize Picks offer an ‘over/under’ bet on Africa becoming the continental powerhouse of the global economy; however, if they did, I would consider taking the over. There are many factors at play that…

Read MoreAnother year has come and gone, and the New Year resolutions are in! With 2026 ahead of us, this is a good time to review our financial annual tasks to ensure that we are “tracking” on all planning matters. Here…

Read MoreAt the start of a new year, when many New Year resolutions might not survive the month, I wonder how the predictions of major Wall Street Firm’s will look by the end of the year? So, let’s dust off Wall…

Read MoreIf you’ve avoided one brain rot zeitgeist, you or your kids may have unknowingly become entangled in another. I have recently discussed the comings and goings of the latest kid-speak with my two little ones. They are in sixth and…

Read MoreAs the holiday season approaches, we want to reflect on the resilience and the power of long-term planning. The past year brought its share of challenges, but it also offered opportunities. Despite periods of volatility, markets demonstrated strength, supported by…

Read More