Q2 2016 Client Letter

July 2016

This time last year we were writing about the remarkable calm in financial markets while anticipating the inevitable return of increased volatility. While higher volatility is uncomfortable it also provides opportunity. At the close of the second quarter the S&P 500 was up 3.8% year to date and has since pushed above its all-time high. U.S. small cap stocks have rallied and were up 1.4% and, perhaps most surprising of all, the bond market as measured by the Barclays Capital Bond Composite was up 4.3%. International equities were split with developed markets down -6.5% and emerging markets up 5%. Despite lingering uncertainty, resilient returns across an array of asset types and limited inflation should make most investors feel wealthier.

Cheer is still tempered by uncertainty as markets have been anything but calm over the past year. Analysts expecting an increase in volatility had their views confirmed as 2016 began with a sharp sell-off that marked the worst ever calendar year start in the history of the S&P 500. Markets switched to rally mode in mid February. The rally was interrupted by the surprise vote in Britain to exit the European Union which triggered a global sell-off in equities wiping out $2.1 trillion of stock market value. European markets suffered worst as the future of the European Union came into question. The sell-off was short lived however, lasting only two days as equity markets once again reversed course to rally back to levels above those seen before the UK referendum. A volatile global market whipsawed in 4 days, falling dramatically and then snapping back.

Meanwhile yields in the fixed income markets are at or near all-time lows. 10-Year U.S. Treasury yields briefly touched 1.39% while 10-Year German Bund yields ended the quarter at -0.12% and Japanese government bonds were at -0.25%. According to data from Bianco Research, 36% of the $35 trillion global sovereign debt market had a negative yield as of June 30. In fact, 77% of the global sovereign debt market was yielding less than 1% while only 6% of the market was yielding more than 2%. With a more challenging landscape of remarkably low yields, meaningful investment income can seem elusive.

In a riskier world, capital seeking safe havens has caused the demand for investments like secure and liquid government bonds to produce equity-like total returns. Including price appreciation from falling yields, 30-Year Treasuries returned an astonishingly high total return of 16.9% in the first half of 2016, more than four times the return of the S&P 500! This is an unusual state of affairs.

Three main themes are worth emphasizing in the current period. First, realized returns are likely to be lower going forward than they have been in the past. In response to a persistent low rate environment, investors have been forced to assume more risk than they would normally prefer. Prices of both stocks and bonds have been bid up to historically high levels as investors reach for yield. Future returns seem to have been accelerated leaving diminished opportunities as investors begin to settle for lower expected returns in a world of higher volatility.

Second, uncertainty remains present and is likely to stay high for the foreseeable future. Britain’s vote to exit the European Union has shocked markets and set in motion a process that will take years to resolve. Increased fear and uncertainty have put further downward pressure on European equity prices, especially in the financial and consumer cyclical sectors. Investors have been more eager to own market segments with perceived safety such as consumer staples, and are less eager to own banks or firms in more cyclical sectors like automobile manufacturing. Investors have likewise flocked to familiar U.S. stocks while shunning their European counterparts that appear riskier.

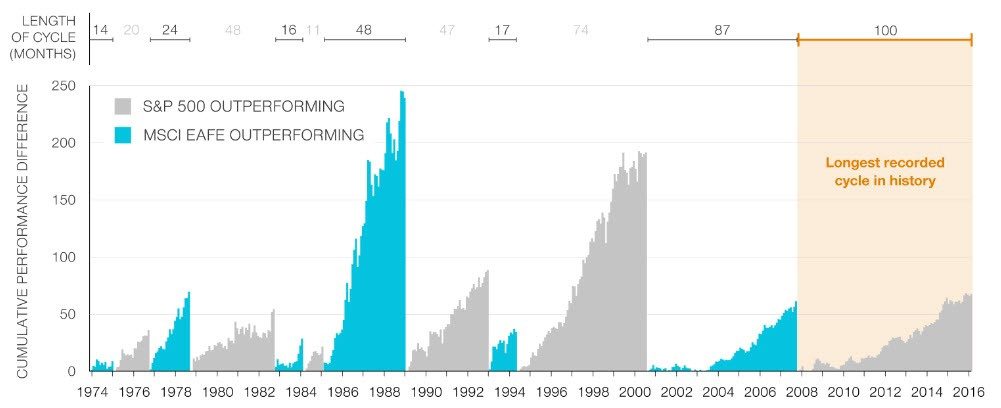

These investor preferences have created an apparent imbalance that may offer opportunity for returns going forward. The relative performance of U.S. versus international stocks tends to run in long cycles. As shown in the chart below, U.S. stocks have outperformed international stocks since the financial crisis of 2008, the longest recorded cycle in history. International stocks as measured by price/earnings ratios appear to represent more attractive values than their U.S. counterparts. The Shiller P/E ratio, a measure of how much equity investors are willing a pay for longer-run corporate earnings, is currently 13 for the MSCI EAFE Index vs. 26 for the S&P 500 Index. Market observers wonder how long such relationships can remain out of balance.

Our third theme, one that we have practiced for years, recognizes that the investment world extends beyond the public markets of stocks and bonds and increasingly favors holding a diversified blend of private investments. Allocations to private real estate, private debt, private equity, and hedge fund trading strategies involve their own unique set of risks and are not appropriate for everyone. Where circumstances allow these areas offer the potential for uncorrelated return streams, access to less efficient markets, and the potential for enhanced risk-adjusted returns; all favorable characteristics in today’s low growth and low yield environment.

Finally, we would like to recognize our summer interns who have been working with us the past few months. If you happen to come by the office please say hello to Nirvanna Silva who just graduated from Brevard College, and Kyler Allen currently at Georgia Tech.

As always, we welcome your thoughts, and appreciate the confidence you have placed in our firm. We hope you have a wonderful summer.

Nicholas Hoffman and Co.