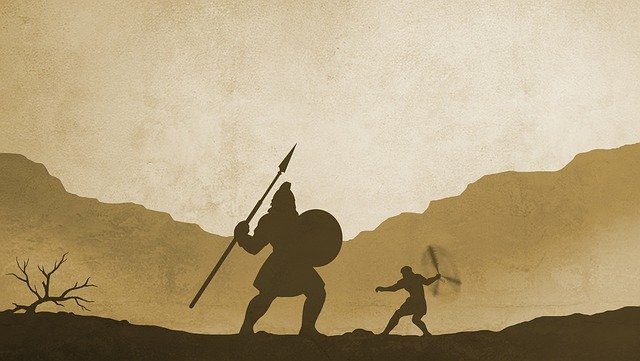

David and Goliath

February 2, 2021

Before the market opened last Wednesday, I got a text message saying: “watch AMC today.” At the time I didn’t take much note other than to reply: “why?” The response back was a quick: “you’ll see.” I soon realized that last Wednesday’s stock du jour was AMC, which followed GameStop from the day before. By this week I was receiving texts such as: “you get your silver last week?” My texting buddy was my college aged son who seems to have been moonlighting between history classes as a day trader and is now providing stock tips. With GameStop and AMC stocks skyrocketing, and now the silver price is soaring, it seems Reddit’s WallStreetBets is the next new thing especially for the young set. I have a Reddit app on my phone, but I have never really bothered to use it much. Perhaps I should take note.

I wouldn’t buy a stock based on a band of social media followers, but I had noticed that gold and silver had quietly drifted lower while Bitcoin was almost doubling in value. The “short squeeze” on GameStop and AMC are classic short covering rallies when the investors buy up the “float” and cause the short-sellers to cover their positions at lofty prices. The Reddit Warriors might find the silver market somewhat harder to manipulate than GameStop and AMC. It seems true that the gaming of GameStop shares pitted the legions of Reddit Warriors against Wall Street – a classic David and Goliath story.

I’ve always rooted for the underdog (unless they’re playing my favorite team) and prefer to see the status quo disrupted. In fact, I’ve always liked the thinking of the early 20th century economist, Joseph Schumpeter, who popularized the term “creative destruction.” The Reddit Warriors’ tactics might not meet Schumpeter’s concept of “economic innovation,” but they are wreaking havoc with the wealth accumulation of some hedge funds.

I did a quick internet search on the story of “David and Goliath” and I came across this article containing some interesting lessons the parable has taught us over the ages:

“Speed and agility beat size” – There is no doubt the Reddit Warriors caught the Wall Street titans by surprise.

“Disrupt the rules and status quo” – There aren’t many rules on Reddit (at least there are no manners) and the Reddit Warriors arguably broke many rules of Investing 101.

“Live on the cutting edge of technology” – Yes, social media has greatly changed our lives in so many ways, as we’ve recently learned, whether it’s politics or day trading.

“Precision matters” – Attacking the enemy in the right place can be lethal – just ask hedge fund guru Stephen Cohen.

Perhaps the Reddit Warriors should read their history lessons on the Hunt brothers and their disastrous attempt to corner the silver market back in 1980. As postscript to the lessons we learned from David and Goliath, perhaps we should add one more lesson to the textbooks – “Fool me once shame on you. Fool me twice shame on me.”

Gary B. Martin, CFA