Gone Public

June 28, 2021

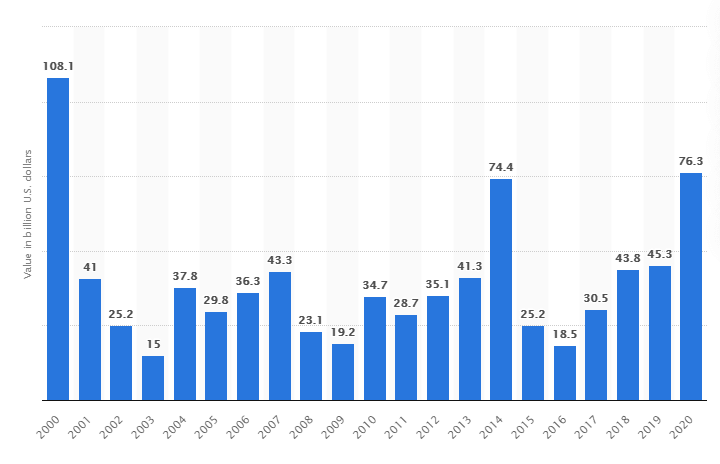

For many years venture-backed tech companies chose to remain private for longer, relying on available capital in the private markets instead of completing initial public offerings (IPOs). Recently, robust public markets appear to be luring some companies to the public side. 2021 has already seen nearly as many traditional IPOs as the annual average over the last ten years. June alone has seen 43 offerings. According to Renaissance Capital, an IPO-focused research firm, 197 traditional IPOs have priced so far in 2021, raising $70 billion for the companies whose stocks are now investable to the public.

Traditional IPOs have faced criticism for permitting a narrow group of investors (typically clients of the IPO’s underwriting banks) to buy IPO shares at an artificially low offering price. Some claim the low prices are engineered, resulting in a first-day share price “pop,” leaving retail investors to buy at higher prices. Data from University of Florida professor Jay Ritter, who studies IPOs, shows that since 1980, the first-day return of IPOs has averaged 20%! Ritter estimates that IPO issuers have left a cumulative $200 billion on the table by setting offering prices that were arguably too low.

An alternative to an IPO is a direct listing which allows companies to bypass high fees (often 3.5% to 7% of IPO proceeds) and alleviate concerns about fairness to investors. Until recently, however, direct listings did not permit companies to raise new capital. Only a smaller collection of well-capitalized companies, including Spotify and Slack, have opted to go public via direct listings.

Special-purpose acquisition companies (SPACs) have provided a third listing option. SPACs have recently dominated investors’ attention and overall listing volume. So far in 2021, SPACs have exceeded other listing types in number and capital raised, totaling 349 with $108 billion raised. Enthusiasm now seems to be waning for these “blank-check companies,” which raise capital from investors and then find a private company with which to merge. There are hundreds of these SPACs already in place with less than two years to identify a merger target and complete a deal.

Strong investor demand and high capital availability have created a healthy exit environment for private companies preparing to go public. Over the past few years, venture-backed companies have represented about two-thirds of traditional IPOs. SPACs have given high-growth companies and their venture capitalist investors another avenue for liquidity.

Ritter’s data shows that IPO investors face challenges. The five-year ‘buy and hold’ returns from the offer price are negative for most IPOs. Larger companies seem to do better. For example, ‘only’ 44% of IPOs for companies with over $100 million in sales generate negative five-year returns for investors.

Recently, retail trading platforms like Robinhood and SoFi announced plans to let their customers begin participating in IPOs. The impact of broader participation in newly public companies is yet unknown. Will the extra investor demand encourage more companies to go public? Will the less experienced investors get burned by the different risks of IPOs? Time will tell.

Cam Simonds