Keeping Up with Inflation

November 1, 2021

Lately, our household has been in a mode of rearranging. With a new baby arriving after Thanksgiving, our two-year-old big sister-to-be is preparing to move out of the nursery and into her “big girl” room. Thus began the search for a dresser of a certain size for her new closet. The search proved difficult. Many options were out of stock or back-ordered. Others priced as if they came fully stocked with clothes. We should not have been surprised. Furniture costs have risen by 11.2% over the last 12 months.

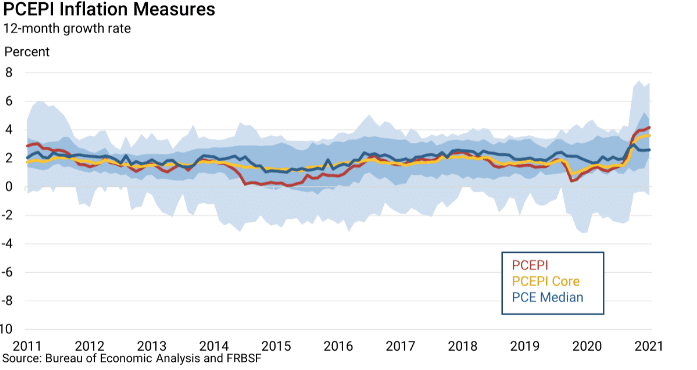

Experiences like this are now familiar to us all. As supply chain disruptions and labor shortages continue, consumers, investors, and central bankers are gradually acknowledging that inflationary pressure may not be ‘transient.’ The Personal Consumption Expenditures index, which is the Fed’s preferred measure of inflation, recently reached a three-decade high, indicating prices having risen 4.4% over the past year. We are not alone. Germany recently posted a 4.5% inflation rate for September, its highest reading in 28 years.

The effects of inflation are now having an impact on short- and medium-term bond yields globally as bond buyers demand higher yields to compensate for the risk of higher inflation. In the past month, the yield on Australian 5-year government bonds has nearly doubled, spiking from 0.75% to 1.45%. Spanish and German 5-year bond yields have also been on the rise, drifting upward toward positive yield territory after sporting negative yields throughout the past few years.

One silver lining of rising costs is their effect on inflation-adjusted income streams and contribution caps for tax-advantaged accounts. The Social Security Administration recently announced that a 5.9% cost of living adjustment will apply to social security payments beginning in January 2022. Retirement savers will be able to contribute an additional $1,000 to employer-sponsored retirement plans with the employee contribution limit rising to $20,500 for 2022, although catch-up contributions for those over 50 will not be increasing.

Perhaps the most noteworthy beneficiaries of higher inflation are holders of I-Bonds. I-Bonds, issued by the U.S. Treasury, pay interest based upon the measured rate of inflation over the prior six months while also providing deflation protection and an option for tax deferral. The semiannual rate applies for the following six-month period and has been 3.54% annualized for the six months ending October 2021. Based on the latest report from the Bureau of Labor Statistics, the Consumer Price Index for Urban Consumers on which I-Bond rates are based rose 3.56% between March and September.

This means that I-Bonds’ inflation-adjusted interest rates will rise to 7.1% annualized for the six months starting November 1, 2021. Electronic purchases are limited to $10,000 per individual per calendar year, limiting the ability of new purchasers to load up with I-Bonds. However, those who have accumulated I-Bonds in the past are likely to appreciate their yield relative to other government-backed assets, especially those planning to make a furniture purchase.

Cam Simonds