A Crude Awakening

March 07, 2022

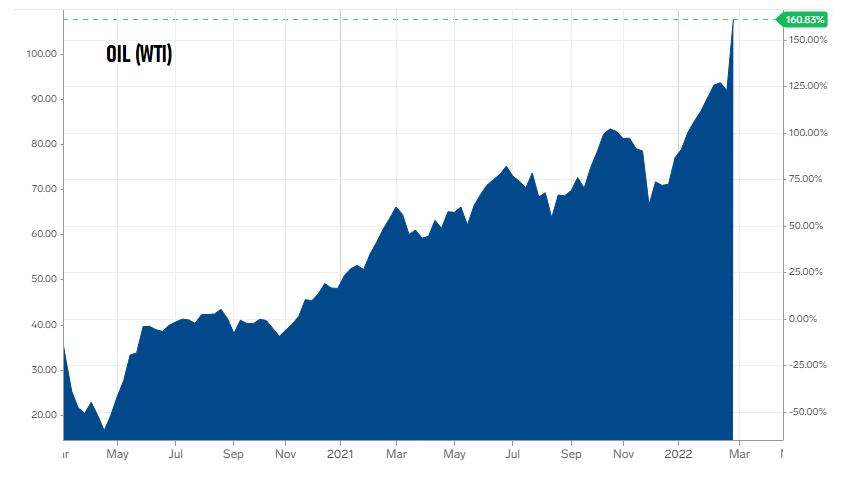

On April 20, 2020, West Texas Intermediate (WTI) crude oil closed at a historic low price of negative $37 per barrel. Briefly, oil was worth less than nothing, and the market was paying buyers to take it. Market participants watched in awe as bids for expiring oil futures contracts vanished. Demand for oil had been shocked by “sheltering in place” as mobility patterns slowed to a crawl. Producers cut oil and gas production as supply far exceeded demand. Storage capacity was at risk of being exhausted.

Fast forward 22 months and crude prices have exploded, soaring over $129/barrel briefly yesterday. At the same time, 2022 petroleum consumption is projected to recapture its pre-pandemic peak. Even before Russia’s invasion of Ukraine, WTI crude oil had reached price levels not seen in 7 years. Now prices have risen to levels only seen briefly in 2008.

Crude’s upward spike comes at a time when inflation is running hotter than it has in decades. The Consumer Price Index, including food and energy, has risen by 7.5% over the past year. Inflation weary consumers face greater expense at the pump, with the national average regular unleaded gas price now at around $4.00 per gallon, according to AAA. Higher transportation costs will exacerbate inflationary pressure for consumer goods.

US crude oil production remains shy of its early 2020 run rate of 12.8 million barrels per day, with production running around 11.5 million barrels per day in late February. Unconventional US shale oil production once considered revolutionary for its ability to quickly ramp up, has failed to close the supply gap. Some blame capital pullback from oil and gas investment. Oil majors have chosen to use cash flow to increase dividends to shareholders rather than funding investments in new production. Dozens of pensions and endowments have joined the fossil fuel divestiture movement, leaving fewer investors willing to capitalize on fossil fuel producers. Other investors’ appetite for oil and gas investing has not returned after the indigestion caused by previous energy market declines.

Non-US producers also seem reluctant to scale up production. Members of OPEC have needed higher oil prices to fund their countries’ social programs. Their response now is key. They are reliant upon oil, but they do not want to push prices so high that alternative forms of energy become more economically attractive.

Another effect of higher oil prices, if sustained, may be increased adoption of electric vehicles. Consumer awareness of EVs is on the rise. This year’s Super Bowl featured seven EV commercials. EVs are forecast to rise from their current 5% share of US total new vehicle sales to 30% by 2030. Higher pump gas prices may speed adoption, and EV adoption could eventually dent oil demand. Over the next few decades, IHS Markit anticipates US oil demand could drop by about 25% in part due to EV adoption.

The energy landscape is evolving rapidly and dramatically. This unpredictable evolution may continue for years.

Cam Simonds