Are Oil Prices Higher?

April 11, 2022

Are oil prices higher now than they were a generation ago? The question seems absurd. Over the past 25 years, the price of West Texas Intermediate crude oil has risen from $21 in March of 1997 to $110 in March of 2022. Oil prices are more than five times higher than 25 years ago.

But a compelling challenge can be made to this view when one steps outside the confines of our fiat currency, expressed in nominal terms, and instead compares the price of oil with something stable. One quite stable, and maybe even accurate, measuring stick is the price of gold.

In March of 1997, the dollar price of oil was $21 per barrel and the dollar price of gold was $361 an ounce. One ounce of gold could purchase 17.2 barrels of oil. In March of 2022, oil prices stood at $110 per barrel and gold at $1,912 per ounce. By this time an ounce of gold could purchase 17.4 barrels of oil. Therefore, when measured by the price of gold, the oil prices were virtually unchanged over 25 years. Indeed, the gold/oil ratio has averaged 17.2 over the 50 years since the U.S. abandoned the gold standard in August 1971.

An analysis by David Hammes and Douglas Wills titled Black Gold: The End of Bretton Woods and the Oil-Price Shocks of the 1970s reached much the same conclusion about the “high” oil prices of the 1970s. Their observation was that despite the steep rise in the dollar price of oil, the gold price of oil was comparatively little changed from the start to end of the decade.

There are short-term swings in the oil/gold price ratio as geopolitical and supply/demand factors are inseparable from a commodity as important as oil. During the early stages of the pandemic oil was very cheap in both dollar and gold terms as demand fell sharply. The current Russian invasion of Ukraine is an example of the opposite effect with supply being restricted and demand beginning to pick back up. But the seemingly gravitational pull of the long-term relationship between oil and gold continues to prevail. In the very long term it is reasonable to expect the ratio to change as oil reserves are depleted, but that process is slow and incremental.

So, from a ‘technical’ perspective the dollar price increase in oil over the past several decades is an illusion which has little to do with supply and demand factors. The real underlying reason is the decline in the purchasing power of the dollar when it comes to the cost of both oil and gold, and that decline has created the illusion.

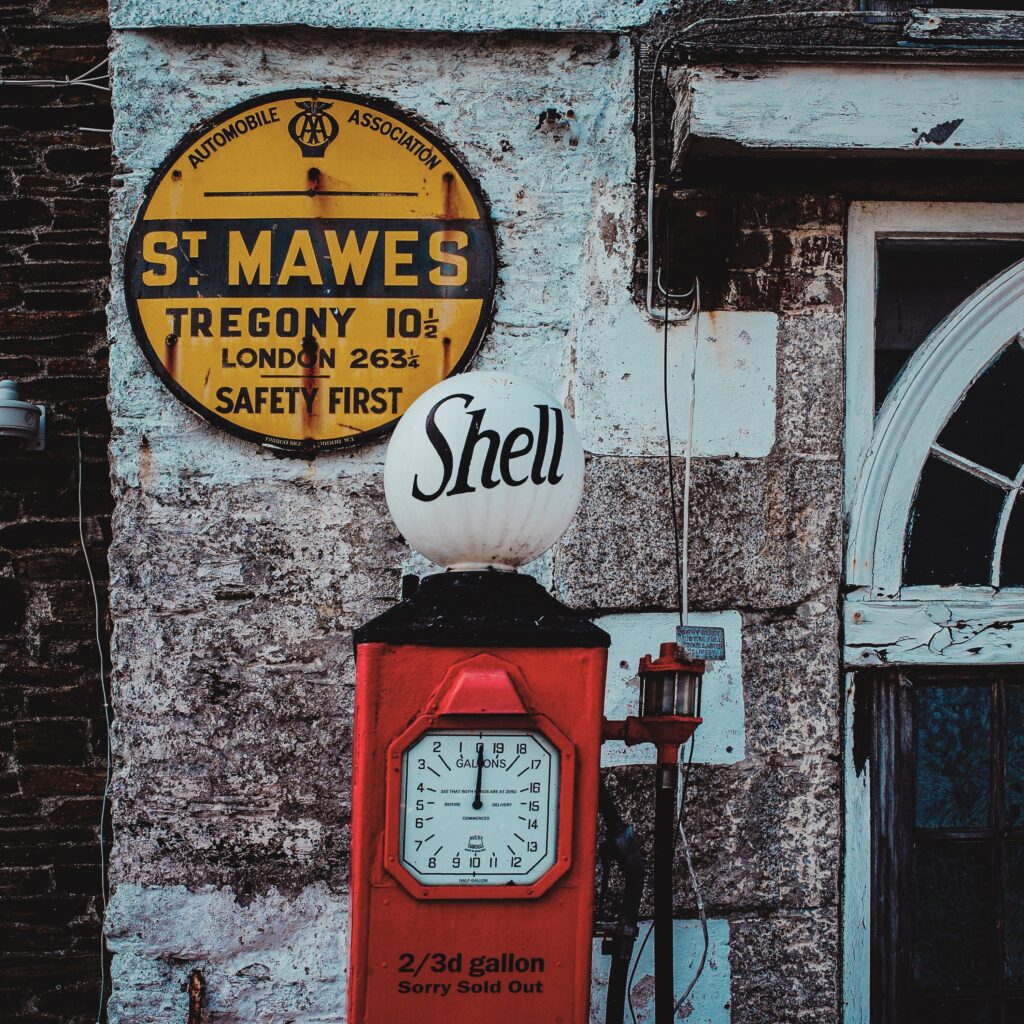

Of course, these technical discussions are not helpful to somebody who has to fill their gas tank 2-3 times a week – unless of course they are being paid in gold doubloon. Maybe a revival of those famous coins could give cryptocurrency a run for its money?

Jeff Buck