A Silver Lining for Higher Rate Environments?

Interest rates are currently hovering near their highest point in years. Most headlines focus on the resulting challenges such as more expensive debt. But there is a silver lining we shouldn’t overlook – elevated interest rates create opportunities for estate and income tax planning.

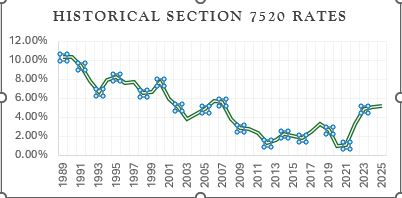

The Section 7520 interest rate, a monthly figure published by the IRS, hovers near its highest point in almost twenty years. This often-overlooked rate plays a key role in valuing certain trusts. When it rises, it enhances the initial charitable deductions for Charitable Remainder Trusts (CRTs) and reduces the lifetime gift/estate tax exemption needed to fund Qualified Personal Residence Trusts (QPRTs). This technical detail may sound minor, but its impact on your estate planning could be substantial.

Charitable Remainder Trusts (CRTs)

At their most basic, CRTs pay income to designated beneficiaries – monthly, quarterly, or annually – before ultimately transferring the remaining assets to a charitable organization. Various CRT types exist (CRATS, CRUTs, NICRUTS, NIMCRUTS), each supporting philanthropic goals while enhancing financial planning.

For investors with concentrated, highly appreciated assets, charitable entities, including CRTs, can help diversify such portfolios without triggering capital gains tax. The charitable deduction generated at inception can also help offset taxes from other portfolio rebalancing, creating a compounding benefit for your overall tax position.

These trusts provide a fixed annuity or variable income stream for a set term or lifetime. This ability to structure cash flow can improve flexibility in managing income and taxes. Ultimately, the charitable remainder can reduce the size of the donor’s taxable state while supporting causes they care about – a win-win that aligns financial planning with personal values.

Qualified Personal Residence Trusts (QPRTs)

As the name suggests, QPRTs are designed specifically to hold residential real estate property, typically a primary residence or a vacation home. During the trust term, the donor retains the right to live in or use the property, and ownership transfers to the beneficiaries only when the term expires. Donors must pay fair market rent if they remain in the home after the trust term and donors must outlive the trust term to preserve the tax benefits. Additionally, the estate tax reduction must be weighed against the lost basis step-up for beneficiaries who may face capital gains taxes upon selling the property.

Here’s where today’s economic environment creates a unique advantage: when 7520 rates are high, the value of the donor’s retained interest (i.e., their right to live in the property) increases, which mathematically reduces the value of the gift to the remainder beneficiaries – meaning you’ll use less of your lifetime gift/estate tax exemption to accomplish the same wealth transfer.

Capturing Today’s Opportunities

Nobody knows how long the current 7520 rates will last and therefore how long this planning opportunity will remain available. This is one of the occasions where market conditions create challenges in some areas while simultaneously opening doors in others.

When paired with the opportunity to lock in historically high estate tax exemptions, proactive planning now could yield significant benefits for families and the causes they support for years to come.

Whitney Butler