Buffett, Li’l Abner, and Compounding

I came across an article the other day: “How Buffett’s Favorite Comic Strip Reveals the Secrets of Compounding.”

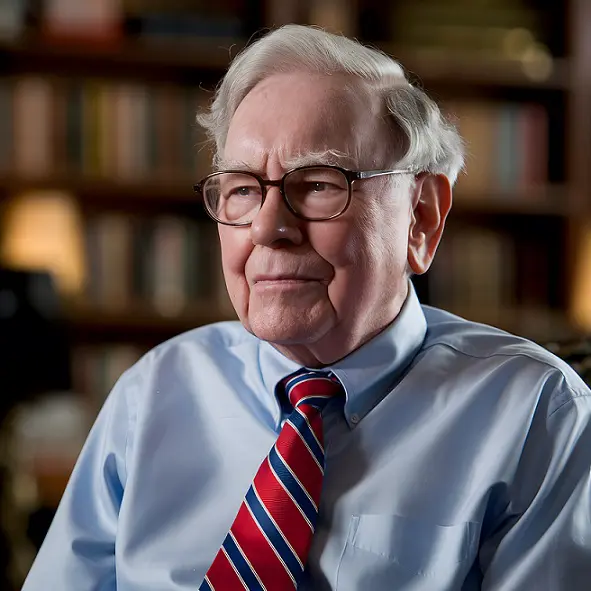

Warren Buffett’s legendary success, averaging 19.9% annual returns over six decades, owes much to two principles: compounding and tax efficiency. Surprisingly, one of his earliest lessons came from an unlikely source: the Depression-era comic strip “Li’l Abner.”

In the story, Abner Yokum dreams of marrying the glamorous Appassionata Van Climax but owns only a silver dollar. Seeking advice, he consults Old Man Mose, who tells him: “Double your money 20 times!” Abner dutifully begins doubling, starting with a lucky slot machine win. Young Buffett found this amusing, but later realized the comic overlooked a critical factor—taxes.

Buffett calculated that if Abner doubled his money annually but paid a 35% tax each time, he’d end up with only $22,370 after 20 years, far short of the $1 million goal. Why? Each doubling shrinks from 2.0 to an effective multiplier of 1.65 after taxes. Over time, this seemingly small difference devastates growth.

Contrast that with a tax-deferred strategy. If Abner invested once and let it compound without selling, after 27.5 doublings he’d have $200 million pre-tax, or about $130 million after paying a single capital gains tax at the end. Buffett quipped: “For that, Appassionata would have crawled to Dogpatch.”

This insight shaped Buffett’s approach of buying quality businesses and holding them long-term. By deferring taxes, investors allow returns to compound fully, using what would have been tax payments as additional investment capital. The IRS becomes a “silent partner,” waiting for its cut years later. Beyond Buffet’s approach, the reader should note that three other well-known vehicles allow investors to compound their capital tax free: Roth IRAs, Health Savings Accounts, and 529 Education Savings Plans.

As a stock, Berkshire Hathaway exemplifies the strategy of tax-efficient long-term holds. Since 1965, its compound annual growth has nearly doubled the S&P 500’s performance. A $10,000 investment when Buffett took control would now be worth roughly $550 million. This remarkable achievement owes much to patience and tax-smart investing.

Frequent trading triggers ordinary income taxes or short-term capital gains taxes. This eroding effect on returns is known simply as “tax drag.” Long-term holdings, by contrast, benefit from lower capital gains rates (0% to 20% for most investors). Historically, capital gains tax rates have changed over time (35% in 1977 versus today’s maximum of 20%), but the principle remains: minimize taxable events.

Buffett’s favorite holding period is “forever.” The longer you hold, the more compounding works its magic while taxes stay deferred. Successful investing is not about chasing quick wins; it’s about structuring your portfolio to maximize growth and minimize tax friction. Like Abner’s quest, wealth creation accelerates dramatically when you let time and compounding do the heavy lifting.

Nick Hoffman