Time for the Old Guy to Retire

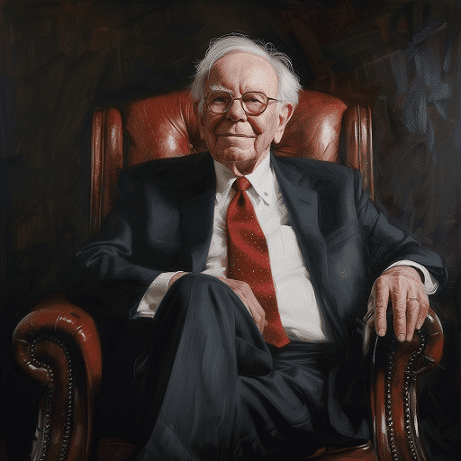

No – I am not referring to either of the pugilists in this year’s presidential prize fight. There are plenty of others who will cover that topic. My comment is focused on Warren Buffett.

As regular readers of this blog will know, we hold Buffett in the highest regard. In fact, our investment philosophy is based around many of the same principles as those followed by Buffett in building Berkshire Hathaway. Examples include having a long-term focus, discipline in sticking to a clear strategy, avoiding being seduced by the latest fad, and not investing in opportunities you do not understand. Not only has Buffett set out a clear and practical investing approach, but his success has demonstrated that these principles work over time.

Buffet is now 93 but continues to be the figurehead for Berkshire Hathaway and its annual meeting in Omaha. The latest meeting took place last weekend. His audience marked his appearance with a level of reverence, which is uncomfortably close to worship. In this regard, Buffett has achieved a status in investing, which is similar to the unquestioning adoration Taylor Swift receives in her chosen field.

But what is wrong with Buffett continuing to be at the helm? Here are my concerns.

First and foremost, the long-term health of any organization is best achieved by an orderly transition between leaders. Transitions that involve a sudden change forced by outside factors rarely go well. Such changes create a sense of vacuum. It then takes time to build confidence in the new leadership. The inevitable ‘outside factor’ facing Buffet is obvious and perilously close for Berkshire Hathaway investors. Even he joked that he had ‘hope’ he would attend the annual meeting next year.

Second, at some level, Buffett fans believe that it is his wisdom and guidance that continues to be behind Berkshire Hathaway’s success rather than his investing principles. Only the latter are long-lasting and provide the framework for success across generations to come.

Third, the longer an aging person stays in a position of leadership, the more likely they will show they have become out of touch, or even that their mental faculties are deteriorating. Buffett continues to be remarkably clear-minded for a man of his age. His prognostications over the weekend on AI, however, were less than helpful. His primary comment was comparing this technology with nuclear weapons. Older folks rarely demonstrate insight and understanding about breakthrough technologies. This seems to apply to Buffett now, too.

Being successful in a position of leadership over a long period can create a sense of indispensability. This sense is often strengthened by ego, even if the person appears modest. But, of course, nobody is indispensable. Even if they were, the circle of life eventually makes that moot. An essential part of good leadership is preparing the way for those who follow. My criticism of Buffett is simply that he needs to quickly do more to ensure the future success of Berkshire Hathaway.

Richard Rushton