Whodunnit

July 18, 2016

Everyone loves a good murder mystery. Some ill-fated person inevitably meets an untimely demise, usually in dubious circumstances. Then the sleuth arrives to solve the mystery using his or her superior powers of observation and deduction. Before we go on, let’s watch a quick video to test our own powers of observation and deduction. This will only take a minute and it will be fun, I promise.

I thought for certain it was the butler.

What makes this clip so interesting is not whether you solve the riddle, but rather how many changes escape your notice while you are focused on the events that unfold. It is a selective perception problem. Turns out we humans are particularly vulnerable to this kind of thing. When we narrow our focus to one task or event, we often miss significant developments even when those developments are right in front of us.

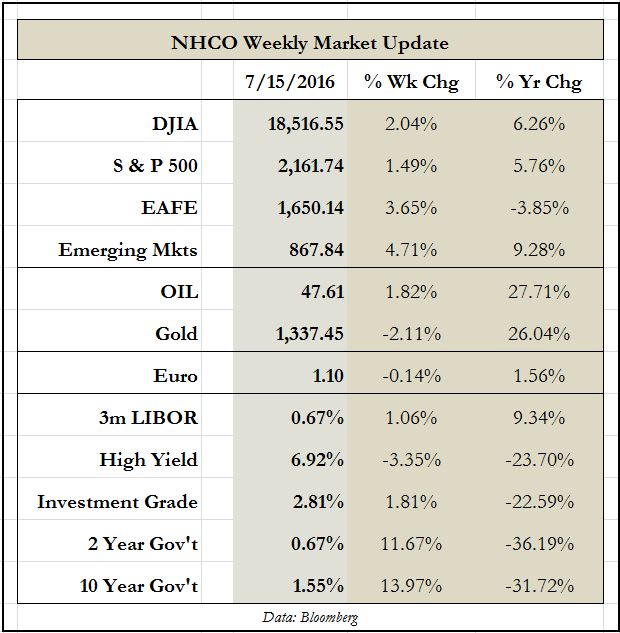

This has implications for investors and students of financial markets. We want to solve the mystery of how one should invest, but with today’s 24x7x365 news cycle, it’s easy to get overwhelmed with the flow of information. Not to pick on anyone in particular, but at the end of the day, the goal of CNBC is to keep us watching through the commercials so they can sell more advertising. It’s more about generating good ratings than about making sound investment decisions. Don’t get me wrong, there’s absolutely nothing wrong with good ratings and we love to own companies that make money. We just need to be aware of the limits or our perception and guard against missing the important developments that may be occurring on the periphery.

One question we get a lot these days is “How will the presidential election affect the market?” It’s a very interesting question and this has been a rather unusual election cycle. When we step back, however, and consider the questions most likely to impact our long-term chances of success as investors, the election outcome is pretty far down the list.

Here are some questions that are likely to be much more important in the long run: Am I properly diversified? How correlated are my return streams? Do I have concentrated risk that I’m not aware of? Am I taking full advantage of the current opportunity set? Are there areas where I’m over or under exposed? Could I be more tax efficient? Could I reduce my fees or expenses?

These are the questions most likely to drive our success going forward. We will continue to follow the presidential election with great interest, but more importantly, we will remain mindful of these critical drivers of success no matter what the news feed brings us.

Mike Masters