The First Trillion is the Hardest

February 28, 2022

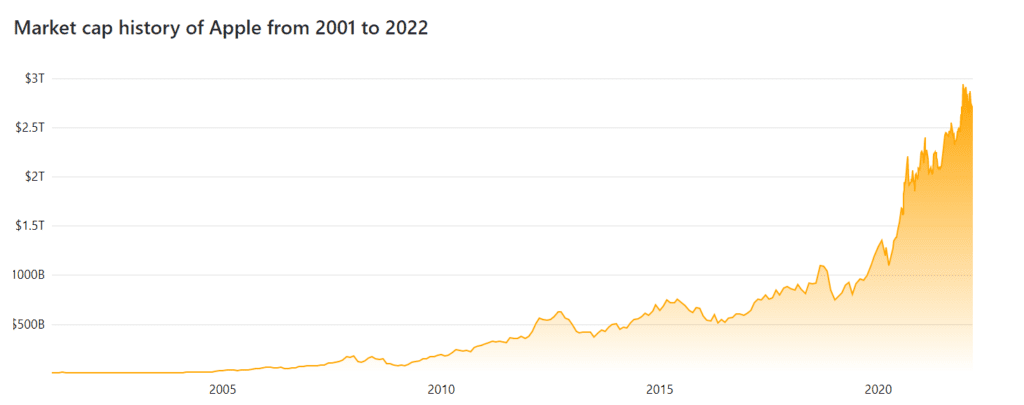

In August of 2018, I wrote here about the Rise of the Mega Company, a short story about Apple and its achievement of becoming the world’s first company to reach a valuation of greater than $1 trillion USD. Founded in April of 1976, it took the company more than 42 years to earn the designation of being the first trillion-dollar company. Since then, however, Apple has done even better, adding its next $1 trillion in just two years. The next trillion, while fleeting, came at an even brisker pace. The company achieved an intra-day valuation of $3 trillion on January 3rd, 2022, just one year and five months later.

Apple is not alone as a trillion-dollar-plus valued company. The next two largest companies in the world Microsoft and Saudi Aramco, are currently valued at over $2 trillion. Amazon and Alphabet, which briefly crossed the $2 trillion mark in November 2021, are not too far behind, both north of $1.5 trillion.

While the growth of these mega companies is impressive, it can lead to certain risks for investors. Of particular note is the increasing concentration of these large companies in market-weighted indices and their respective ETFs. On January 31st, 2022 the top ten holdings of the widely respected Vanguard 500 ETF, VOO, made up 30.1% of the fund’s total net assets. If you look back ten years to January 2012, the top 10 S&P 500 companies made up just 19.9% of the index. A 50% increase in concentration risk over a 10-year period is probably more than what would have been projected in 2012.

Interestingly, only three names appeared in the S&P top 10 in both 2012 and 2022: Apple, Microsoft, and Johnson & Johnson. During the 2012-2022 period, the top 10 list saw energy, manufacturing, and healthcare names replaced by high-growth technology companies such as Alphabet, Tesla, and Meta. As a greater percentage of US equity value is in the largest companies, investors in low-cost, passive ETF solutions may be more exposed to these names than they may realize.

This risk has partially led to the rise of so-called Smart-Beta ETFs or Active ETFs. In an attempt to better diversify investor exposure or to beat the returns of the passive index solutions, these tools strive to replicate the low-cost structures and tax advantages of their more passive cousins while having discretion to over or under-weight individual companies. Additional investor precautions, such as diversifying equity exposure to multiple strategies, geographies, and different-sized companies, can also help mitigate the risks of an increasingly concentrated market.

It is difficult to forecast where these trends will lead us over the next decade, or even the next 5 years. But whatever the journey, strong diversification and a long-term investment philosophy will help guide your portfolio to both take advantage of, and protect against, the risks of a more concentrated equity market.

Carey S. Blakley, CFA